SurchargesUpdated a month ago

There are business use cases where you may want to charge a transaction convenience fee or surcharge.

Surcharges are typically meant to cover the merchant's costs for processing credit card payments, while convenience fees are for providing a convenient payment or service option. Surcharges are subject to rules and regulations, and may be prohibited or restricted in some states, while convenience fees are legal in all 50 states.

Note: PayPack does not currently support surcharges for card payments used with Apple Pay or Google Pay.

Need help making a decision? Please reach out to [email protected] and we will guide you through the process!

Settings

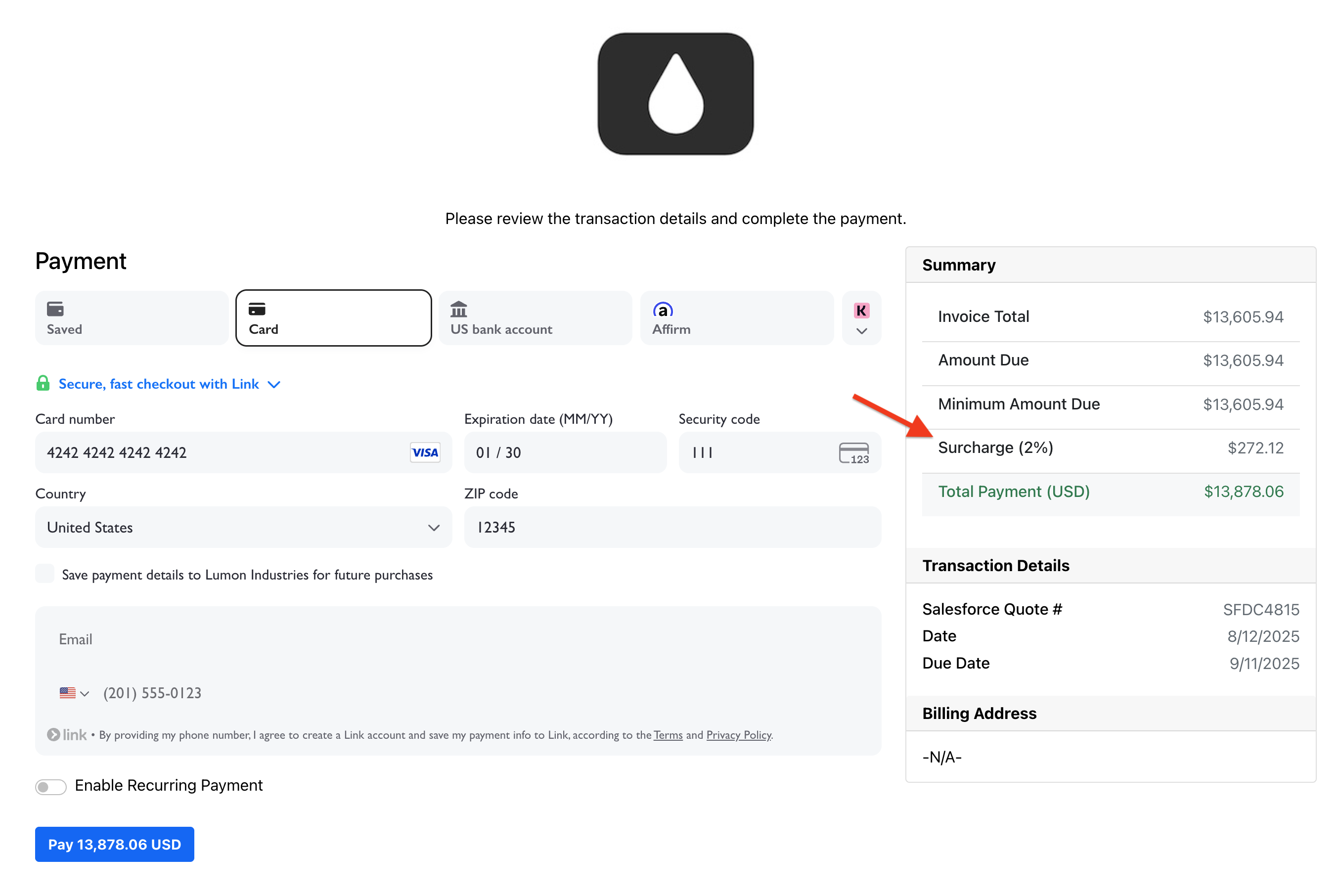

When enabled, the fee can be applied across any PayPack charge on the customer, quote, sales order, invoice, or invoice group. The fee can be configured to apply globally or specifically to a transaction.At the PayPack Payment Link (Customer Facing)

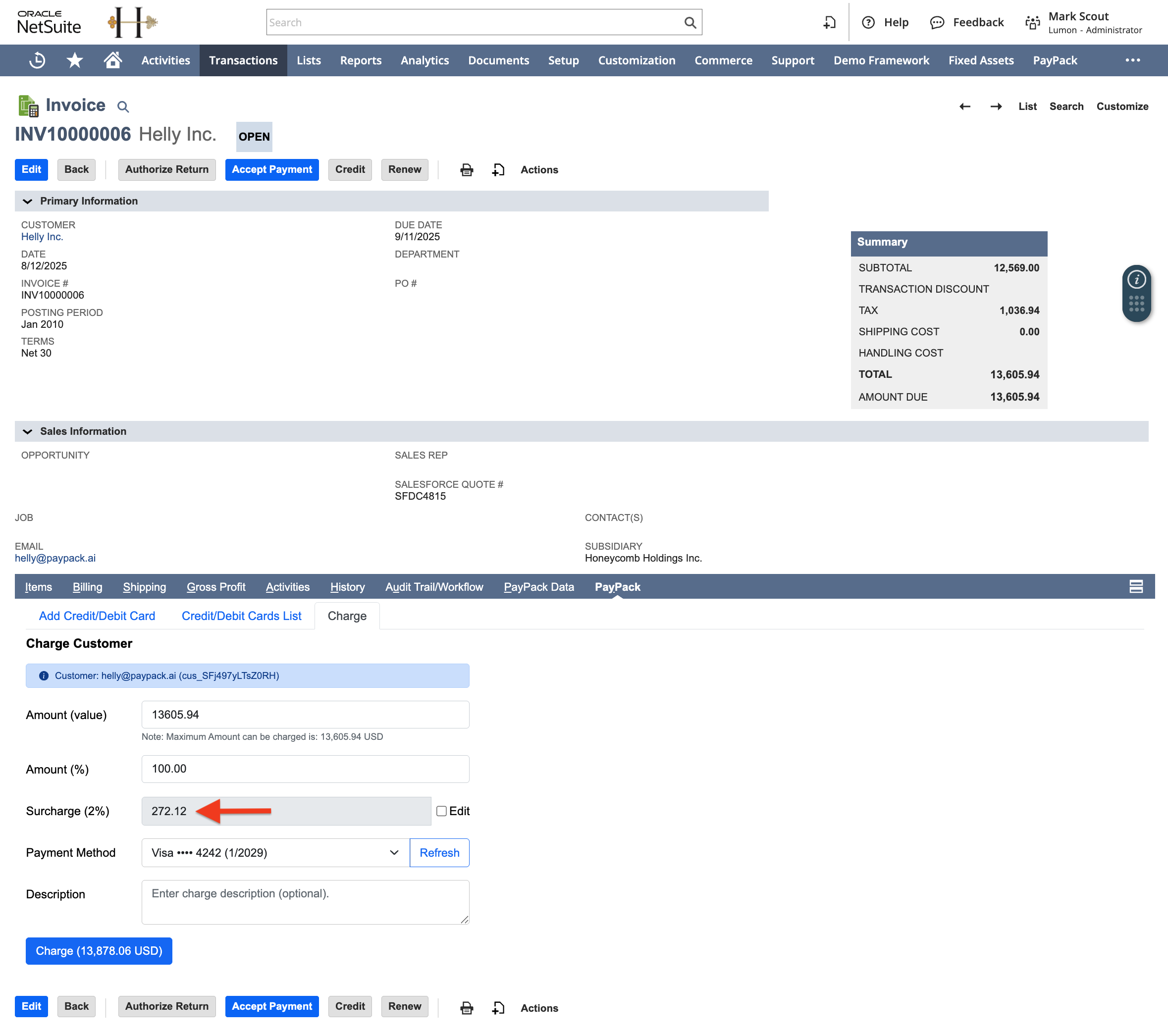

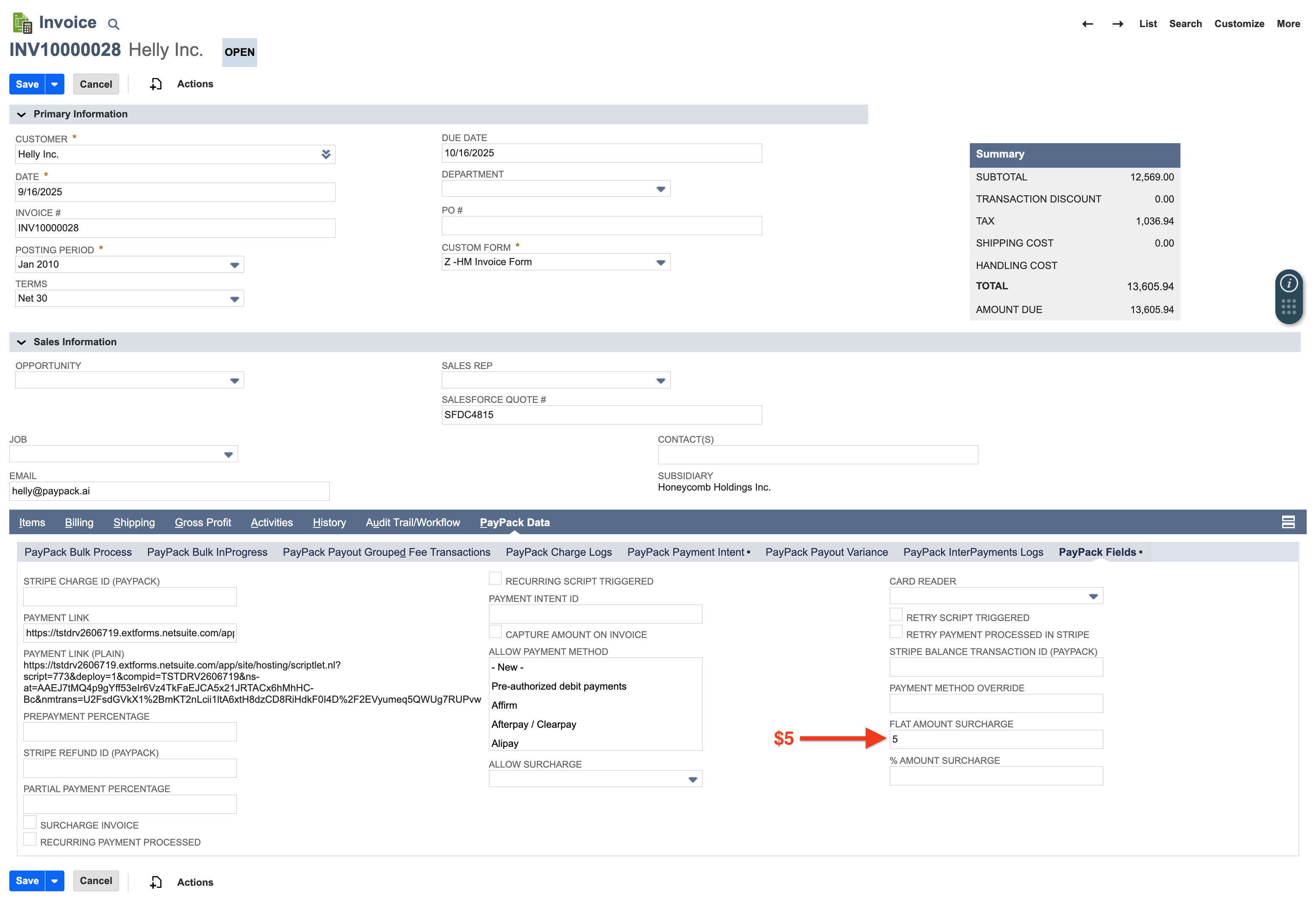

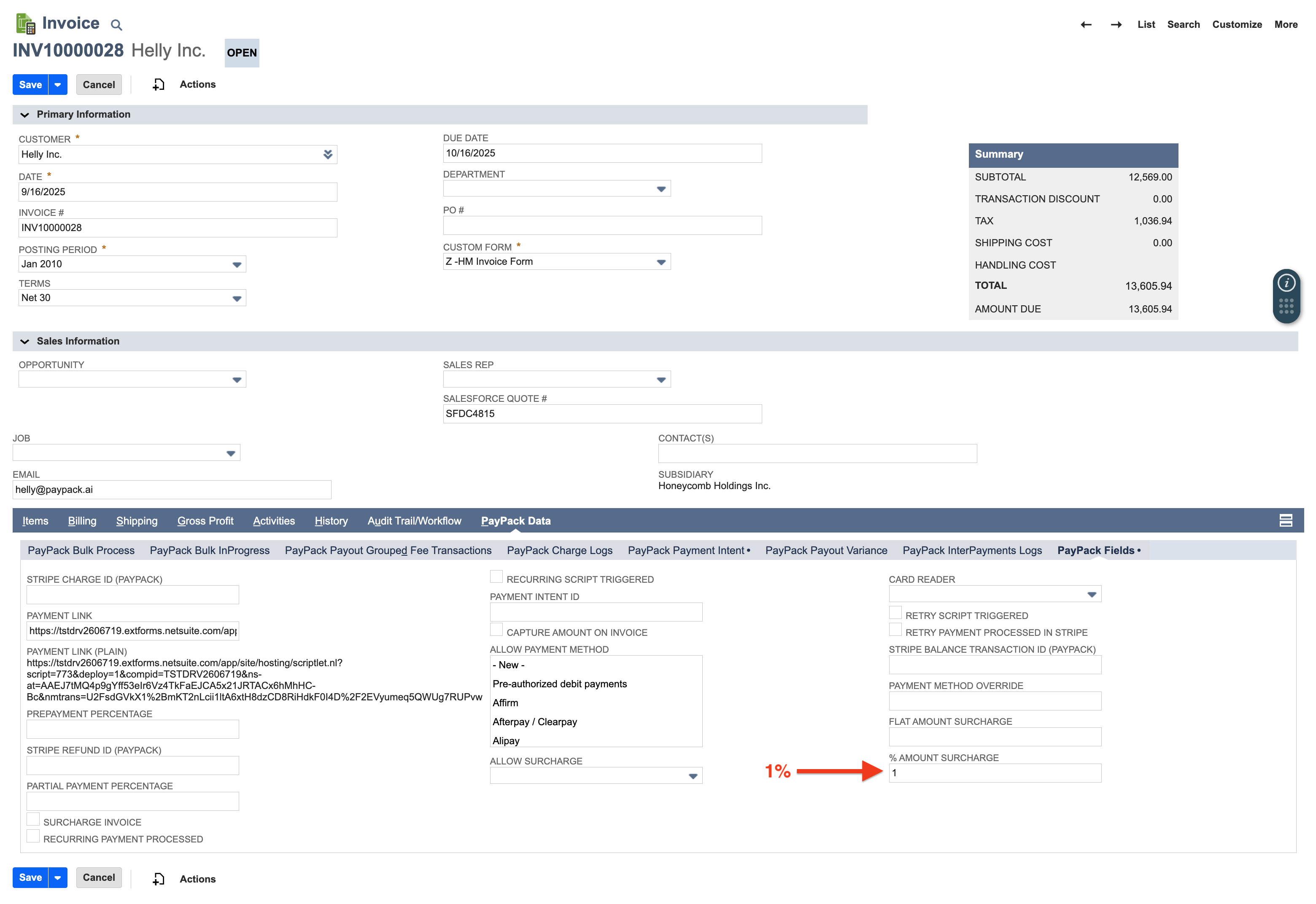

At the PayPack Subtab (NetSuite Admin)

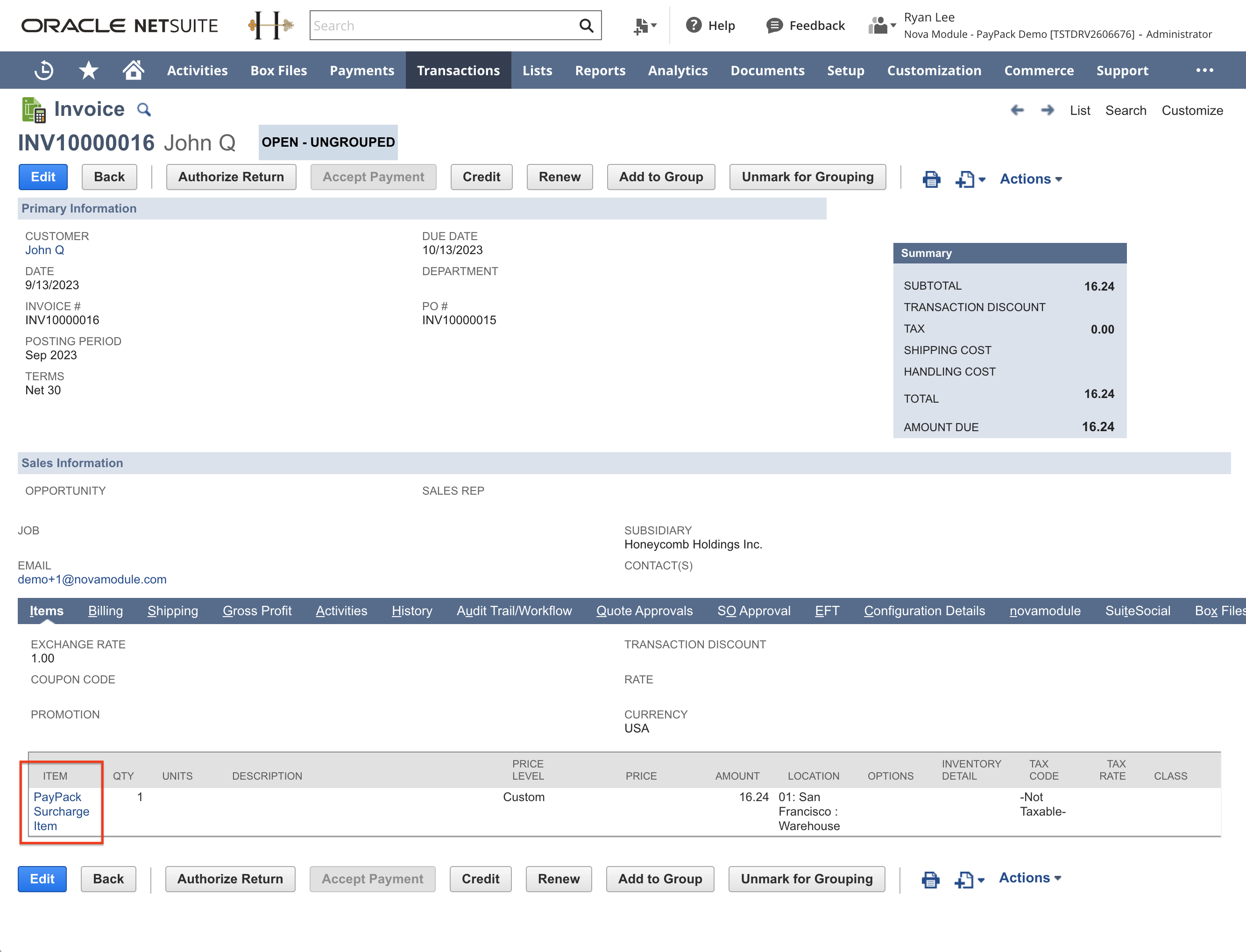

On successful charge, a separate NetSuite invoice transaction is created with a new line item to track the surcharge without impacting the original transaction details.

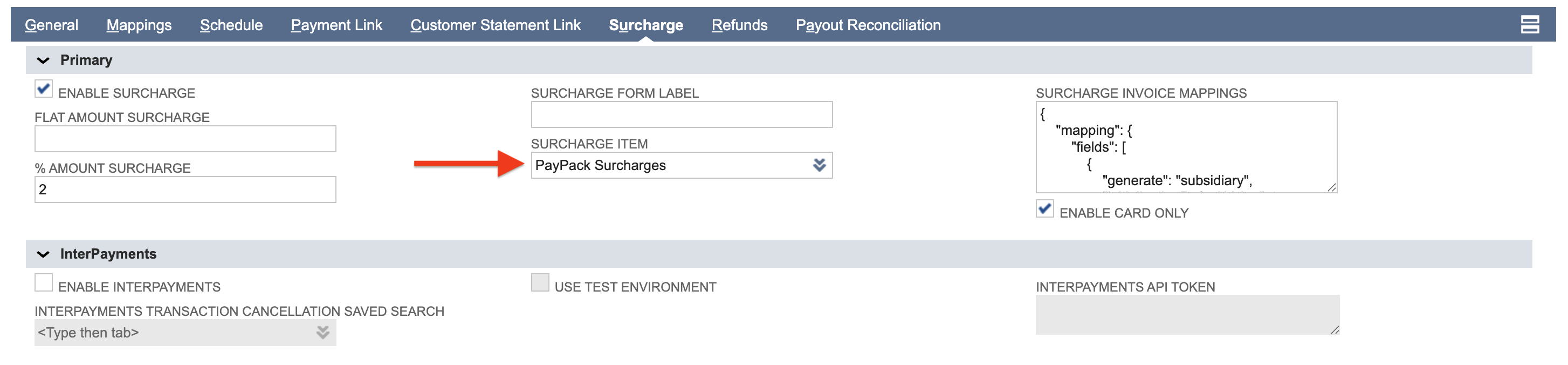

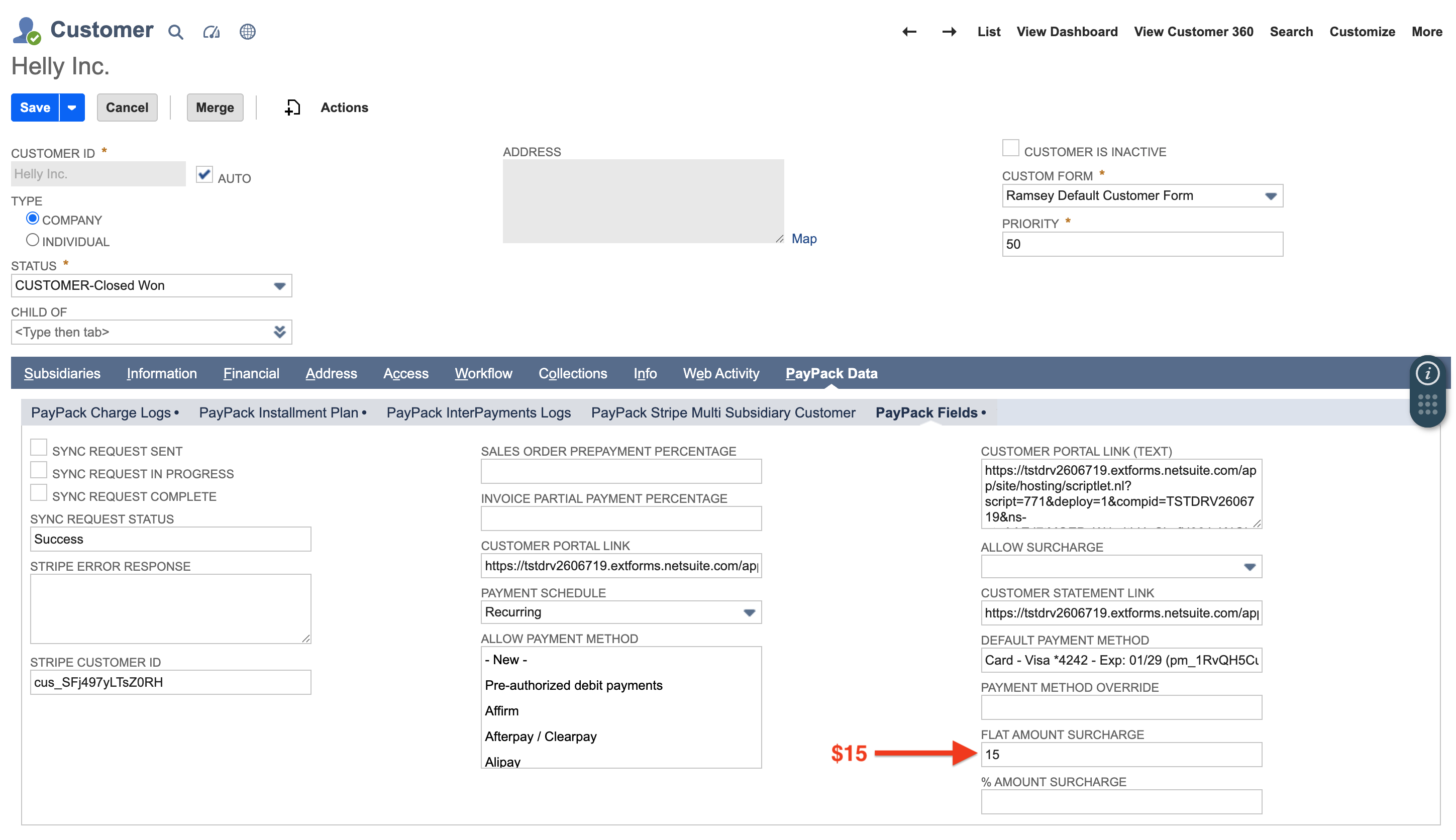

- Flat Amount Surcharge – Enter a static value (i.e. 5 for $5)

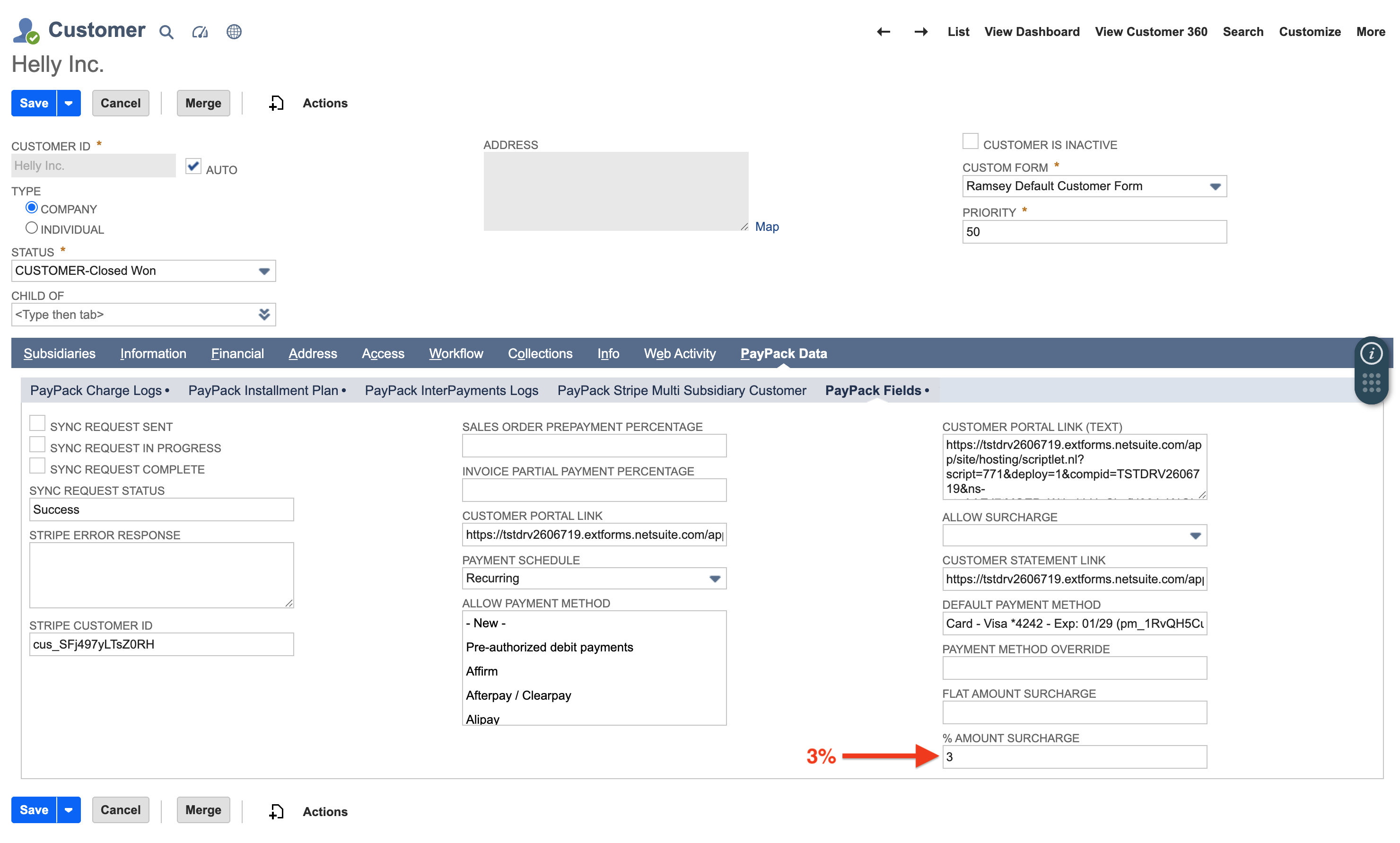

- % Amount Surcharge – Enter a static value (i.e. 3 for 3%)

- Surcharge Form Label – This form label only appears on the payment link page. Typical labels are Surcharge or Convenience Fee. The default label is Surcharge.

- Surcharge Item – Recommend setting up a non-inventory or payment item to collect surcharge totals.

- Surcharge Invoice Mappings – When needing to populate required fields on an invoice transaction, enter metadata in JSON format to satisfy the requirement.

- Enable Card Only – In certain scenarios, a fee may be applied to only the card payment method and not others such as ACH Direct Debit or Cash App.

Sample JSON data for Invoice Mapping

1{2 "mapping": {3 "fields": [4 {5 "generate": "otherrefnum",6 "lookupName": "otherrefnumlookup"7 },8 {9 "generate": "subsidiary",10 "initializationDefaultValue": true,11 "lookupName": "subsidairylookup"12 },13 {14 "generate": "taxcode",15 "extract": "",16 "hardCodedValue": -717 },18 {19 "generate": "account",20 "extract": "currency",21 "fieldtype": "",22 "discardIfEmpty": false,23 "lookupName": "accountlookup"24 }25 ],26 "sublist": {27 "item": [28 {29 "generate": "location",30 "extract": "",31 "hardCodedValue": 232 },33 {34 "generate": "taxcode",35 "extract": "",36 "hardCodedValue": -737 }38 ]39 }40 },41 "lookups": {42 "otherrefnumlookup": {43 "resultFieldId": "tranid",44 "recordType": "parent"45 },46 "subsidairylookup": {47 "resultFieldId": "subsidiary",48 "recordType": "parent"49 },50 "accountlookup": {51 "map": {52 "usd": "201",53 "cad": "101"54 }55 }56 }57}

Customer-Level Settings

Apply or remove surcharges for individual customers.

If you wish to exclude a specific customer from surcharges, this can be easily done with a single drop-down option in your customer record.

Note: If transaction-level surcharge override amounts are set, it takes priority over the customer-level settings.

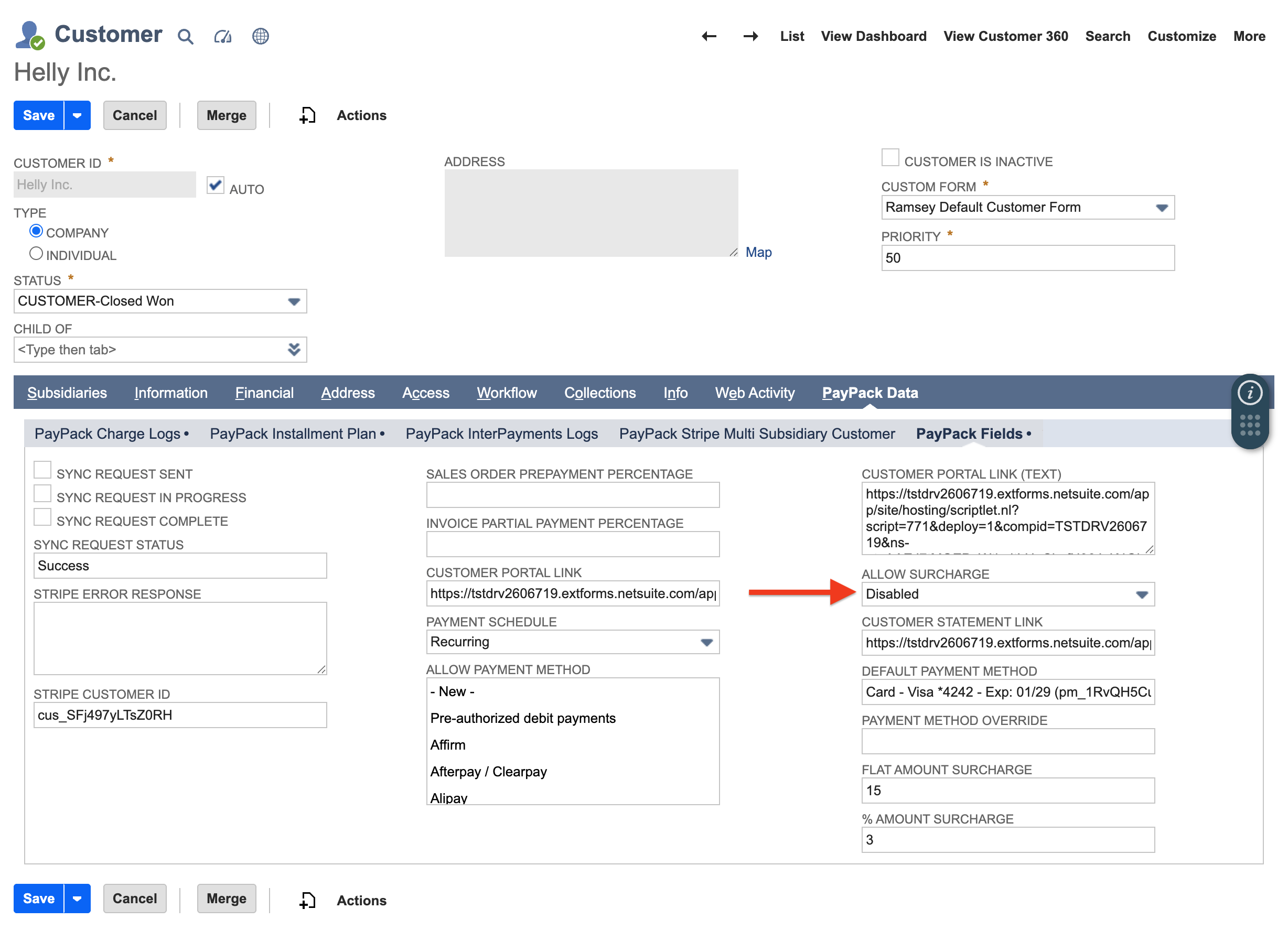

Steps to Disable Surcharge Fees on a Customer

Create or Edit a Customer.

Navigate to the PayPack Section.

Go to the "PayPack Data" sub-tab.

Click on the "PayPack Fields" section.

Set the “Allow Surcharge” option.

Set to Inherited or Disabled. A blank field will be the same behavior as Inherited.

To remove the surcharge for the given customer, select the Disabled from the dropdown.

Click the "Save" button to apply the changes.

Default Behavior:

For all newly created transactions, the “Allow Surcharge” option will be set to "Inherited" by default.

For existing customers already present in NetSuite, this option will initially be empty. This means it will check if the surcharge is enabled in the PayPack Configuration.

If Surcharge is enabled, the surcharge will be displayed.

If Surcharge is disabled, only the transaction total will be shown on the payment link.

Effect on Stripe Payment Link:

Once disabled, the Stripe Payment link for that particular transaction will not display any surcharge.

You can dynamically change the option later to "Inherited," which will make the surcharge reappear on the payment link.

Steps to Override Amount on a Customer

To override the global surcharge configuration amount, use the customer-level setting to apply a different surcharge to a specific customer than what is set for all other customers. This is useful for situations that require exceptions to the standard surcharge policy.

The surcharge customer-level setting can be populated as a flat amount or percentage.

Transaction-Level Settings

Apply or remove surcharges for individual transactions (i.e. Sales Orders, Invoices, Invoice Groups, and Quotes).

If you wish to exclude a specific transaction from surcharges, this can be easily done with a single drop-down option in your transaction record.

Note: If customer-level surcharge override amounts are also set, the transaction-level amount takes priority over the customer-level settings.

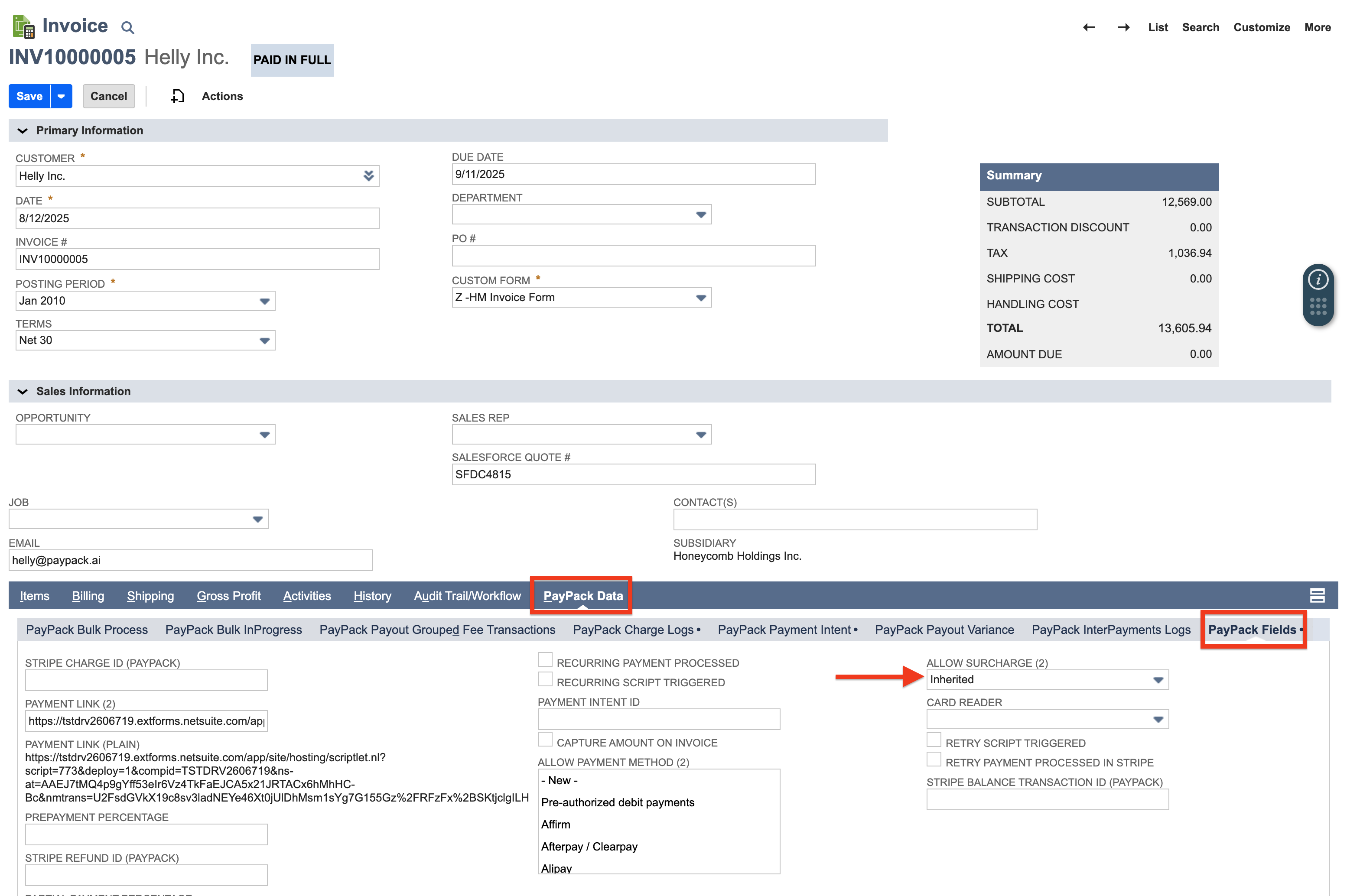

Steps to Disable Surcharge Fees on a Transaction

Create or Edit a Transaction.

Navigate to the PayPack Section.

Go to the "PayPack Data" sub-tab.

Click on the "PayPack Fields" section.

Set the “Allow Surcharge” option.

Set to Inherited or Disabled. A blank field will be the same behavior as Inherited.

To remove the surcharge for the given transaction, select the Disabled from the dropdown.

Click the "Save" button to apply the changes.

Default Behavior:

For all newly created transactions, the “Allow Surcharge” option will be set to "Inherited" by default.

For existing transactions already present in NetSuite, this option will initially be empty. This means it will check if the surcharge is enabled in the PayPack Configuration.

If Surcharge is enabled, the surcharge will be displayed.

If Surcharge is disabled, only the transaction total will be shown on the payment link.

Effect on Stripe Payment Link:

Once disabled, the Stripe Payment link for that particular transaction will not display any surcharge.

You can dynamically change the option later to "Inherited," which will make the surcharge reappear on the payment link.

Steps to Override Amount on a Transaction

To override the global surcharge configuration amount, use the transaction-level setting to apply a different surcharge to a specific transaction than what is set for all other transactions. This is useful for situations that require exceptions to the standard surcharge policy.

The surcharge transaction-level setting can be populated as a flat amount or percentage.

Advanced Revenue Management

NetSuite Advanced Revenue Management (ARM) automates revenue processes (forecasting, recognition, etc.) using rules-based automation.

In order for the surcharge invoice to apply proper GL accounts, use the below field mapping to enable or disable ARM.

Bypass NetSuite ARM on Surcharge Invoice Line Item

1{2 "mapping": {3 "fields": [4 {5 "generate": "userevenuearrangement",6 "extract": "",7 "hardCodedValue": true8 }9 ]10 }11}

Apply NetSuite ARM on Surcharge Invoice Line Item

1{2 "mapping": {3 "fields": [4 {5 "generate": "userevenuearrangement",6 "extract": "",7 "hardCodedValue": false8 }9 ]10 }11}

Compliance Surcharges

To provide merchants a compliant surcharging solution, PayPack has partnered with InterPayments, a leader in compliant managed surcharge solutions.

Read more about our InterPayments partner by visiting our blog post: Reduce Processing Costs with NetSuite Surcharging.

To get started, submit a ticket to [email protected] requesting for an InterPayments account and we will help get you connected with an InterPayments representative.

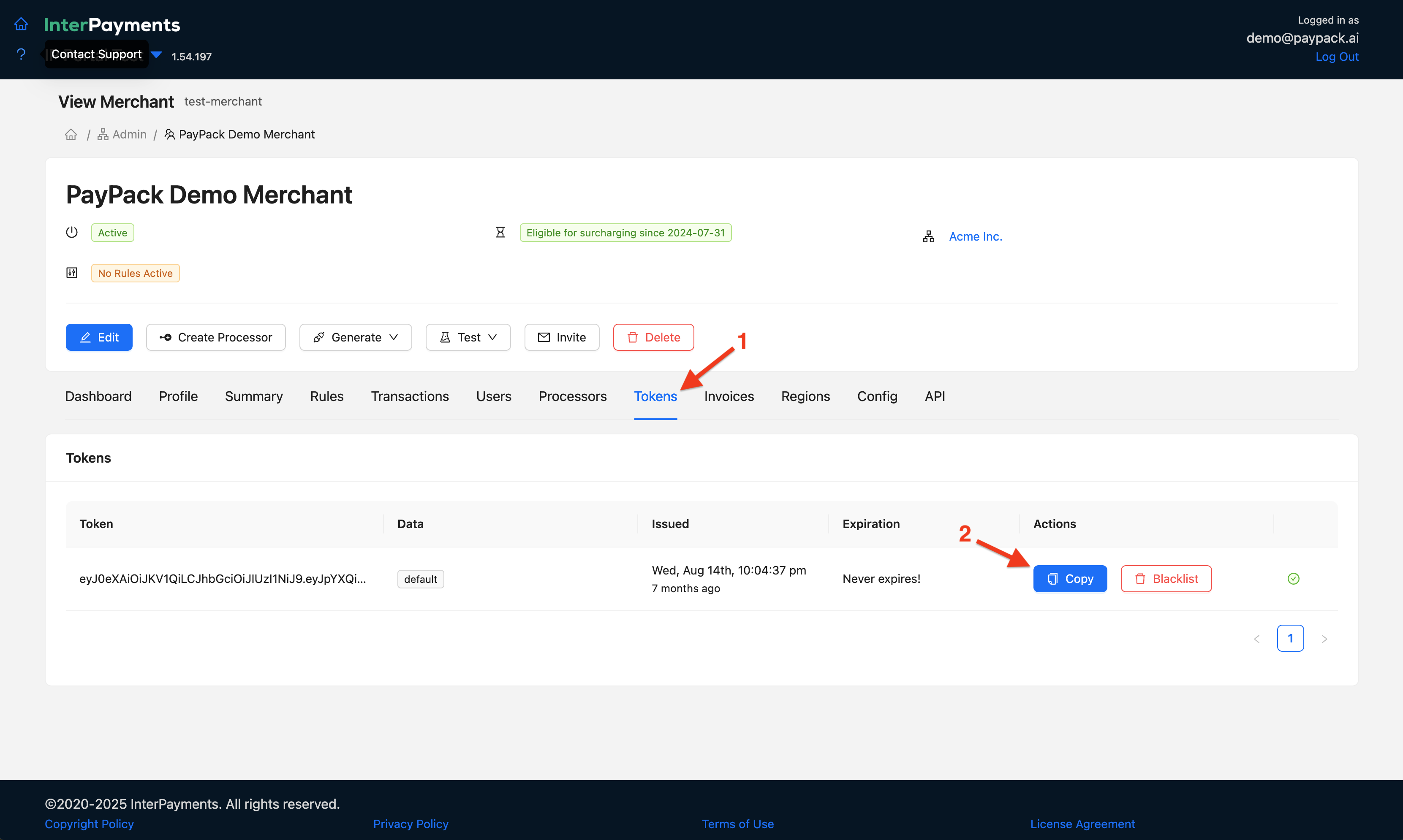

Configure InterPayments

Once you have access to the InterPayments portal, navigate to the InterPayments Merchant Account → Tokens.

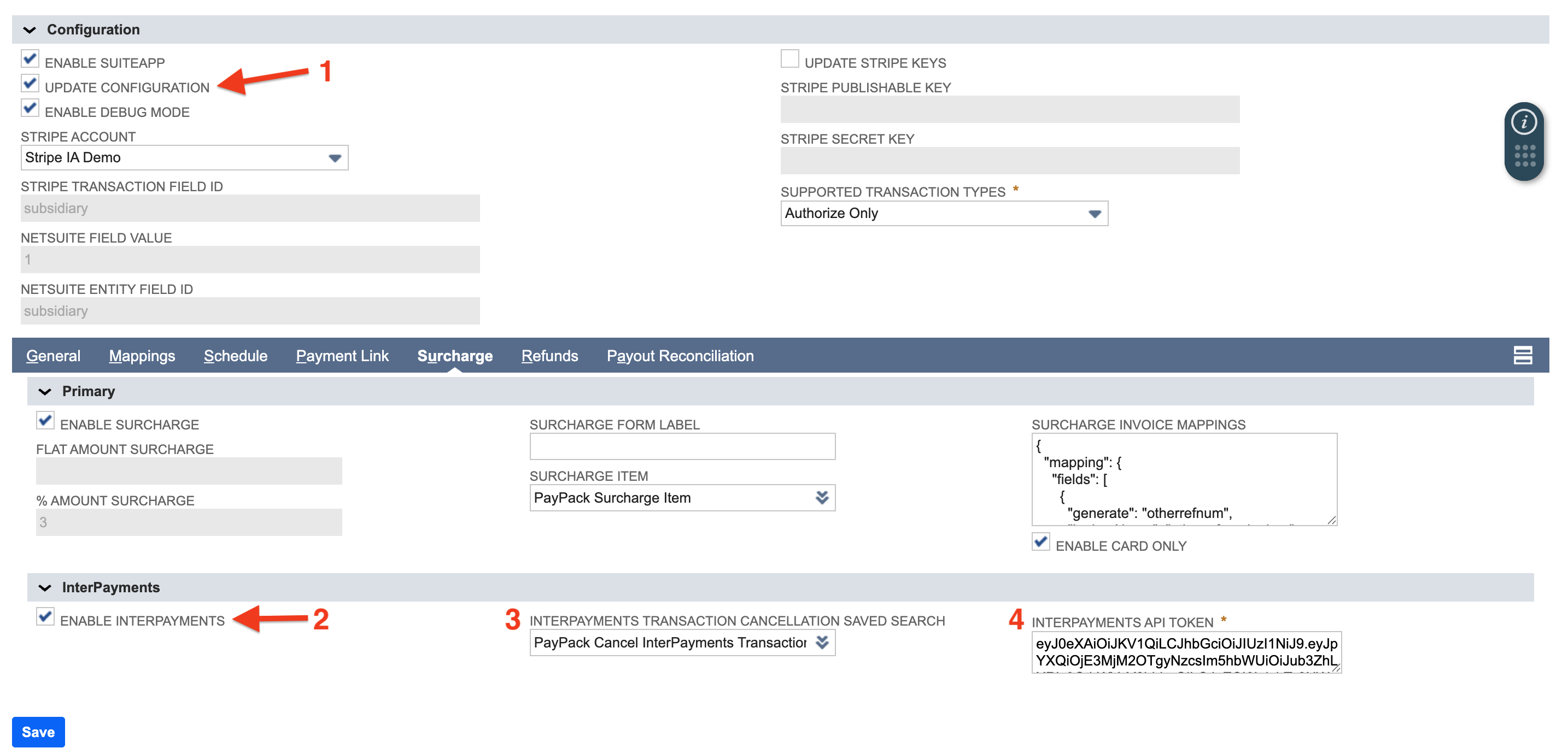

Then go to the NetSuite navigation menu → PayPack → Setup → Configuration page. Once in the PayPack configuration, go to Surcharge subtab and follow the steps below.

- Check the box for Enable InterPayments.

- Add a saved search for InterPayments Transaction Cancellation Saved Search field.

- PayPack includes a template named PayPack Cancel InterPayments Transactions. Use this saved search for reference.

- This saved search is used to cancel old InterPayments requests. The default is set to any InterPayments requests over 10 days old.

- Deploy the script PayPack InterPayments Cancel MR.

- Add the InterPayments token into the InterPayments API Token field.

Surcharge Sales Tax Reporting

When using Avalara for sales tax reporting, surcharges can be handled in two distinct ways.

Option 1 - Automated Reports using Avatax

NetSuite merchants using Avalara can easily set the PayPack Surcharge Item Avatax tax code to OF060001 (Credit card processing fees / charged by seller).

By using this approach, PayPack Surcharge Invoice Items are automatically transmitted to Avatax for tax calculation and reporting.

Option 2 - Upload using CSV

Alternatively, you can manually import surcharge sales tax reporting into Avalara using a CSV template. To do this, create a NetSuite saved search to extract the required data for the template.